Introduction: Understanding the Credit Card Debt Challenge

Credit card debt is a heavy burden for many, but it's important to recognize that you're not alone in facing this challenge. As of the fourth quarter of 2024, total credit card debt in the United States reached a staggering $1.211 trillion. This figure isn't just a statistic; it represents the financial stress felt by millions of individuals and families. In February 2025, the average credit card debt per person was $6,455, while other data shows $6,380 for the third quarter of 2024. The average credit card debt per household is even higher, around $9,214. These numbers highlight the prevalence of this issue.

Delving deeper, credit card debt has surged by $441 billion since the first quarter of 2021, a 57% increase in less than four years. This rapid growth suggests the problem may be exacerbated by economic factors like inflation. Many who have recently fallen into debt are not necessarily "irresponsible" but may be caught in broader economic shifts. The swift increase in post-pandemic debt could stem from a combination of factors: inflationary pressures forcing reliance on credit for essentials, a return to pre-pandemic spending habits, and the possible end of pandemic-related financial aid. This context is crucial for understanding and empathizing with those struggling to escape debt.

Credit card debt is particularly troublesome due to its high interest rates. In the first quarter of 2025, the average Annual Percentage Rate (APR) for interest-bearing credit cards was 21.91%. This means a significant portion of repayments can go towards interest rather than the principal if not managed properly, making the debt reduction process slow and costly. The high average interest rates mean credit card debt isn't just a "borrowing" problem; it's more like a "reverse investment"—the interest paid far exceeds typical investment returns, actively eroding wealth. Viewing debt not just as an obligation but as an active financial drain underscores the urgency of addressing it.

Many credit card issuers set minimum payments very low, often around only 2% of the balance. While this might seem affordable, making only minimum payments can keep someone in debt for years and accumulate substantial interest charges. Furthermore, a noteworthy phenomenon is that less than half (47%) of cardholders carried a balance in 2023. While this might sound positive, it also means the $1.211 trillion debt is concentrated among this segment, making their individual burdens potentially much higher than simple averages suggest. For the target audience truly burdened by debt, the problem can be more acute, thus the strategies offered need to be robust.

Although these figures can be daunting, it's essential to emphasize that escaping credit card debt is an achievable goal with a clear plan and consistent effort. This report will provide practical, expert-vetted strategies to help individuals navigate this challenge and ultimately achieve financial freedom.

Strategy 1: Take Control with a Realistic Budget and Smart Spending Cuts

A budget is the roadmap to understanding where your money comes from and where it goes, an indispensable foundation for achieving debt freedom. Without a budget, it's nearly impossible to find extra funds to pay down debt. Budgeting is about gaining control and making conscious decisions about spending.

Step-by-Step Guide to Creating a Debt-Focused Budget

Developing an effective budget involves several key steps:

- Calculate Your True Income: Determine your after-tax income (net income), including all sources of revenue.

- Track Every Penny: For one month, meticulously record all expenses. Use an app, notebook, or spreadsheet. This step is crucial for revealing spending habits and potential areas for cuts, especially helpful in identifying how "small leaks" add up.

- Categorize Expenses (Needs vs. Wants): Differentiate between essential expenses (housing, utilities, food, transportation) and discretionary spending (entertainment, dining out, subscriptions). The 50/30/20 rule (50% for needs, 30% for wants, 20% for savings/debt repayment) can be a useful guideline.

- Analyze and Identify Cuts: Review the "wants" category. Where can you reduce or eliminate spending to free up money for debt repayment?.

- Set Realistic Goals and Allocate Funds: Determine how much you can realistically allocate extra each month towards debt. Make debt repayment a dedicated line item in your budget.

- Review and Adjust Regularly: A budget isn't set in stone. Review it monthly or quarterly and adjust for changes in income or expenses.

The psychological aspect of budgeting is as important as the mathematical one. Successfully sticking to a budget and seeing progress (even small amounts saved) can build momentum and a sense of empowerment, which is vital for the long journey of debt repayment. As some financial advice emphasizes, "cultivating an empowering mindset", successfully identifying areas to cut and reallocating that money to debt provides tangible proof of progress. This tangible progress can shift the feeling of restriction to one of control, thereby boosting motivation.

Practical Tips for Smart Spending Cuts

Here are some practical ways to cut expenses:

- Scrutinize Subscriptions and Memberships: Cancel unused gym memberships, streaming services, or magazine subscriptions.

- Eat at Home More Often: Reduce spending on restaurant meals and takeout, which can add up quickly.

- Negotiate Bills: Call your internet, phone, cable, and insurance providers to ask for better rates or promotions. Negotiating bills isn't just a one-time fix. Loyalty to providers often goes unrewarded; periodically shopping around or asking for retention offers can lead to ongoing savings, effectively "increasing" money available for debt without drastic lifestyle cuts.

- "Don't Swipe the Small Stuff": Be mindful of small, frequent credit card purchases. Consider using cash for these to better track spending. This guideline isn't just about saving a few dollars; it's about breaking the habit of mindless credit use and fostering conscious spending. This practice can have a ripple effect on larger purchasing decisions. Frequent small credit card purchases can easily become automatic, almost unconscious behaviors. Switching to cash for these makes the spending more tangible and deliberate. This practice of conscious spending on small items can train the brain to be more careful with larger expenditures too, thus preventing future debt.

- Prioritize Free/Low-Cost Activities: Opt for free entertainment like visiting parks, using library resources, or having movie nights at home.

- Delay Non-Essential Purchases: Postpone large, non-essential purchases until your debt is under control.

Strategy 2: Choose Your Debt Attack Method: Snowball vs. Avalanche

Making only minimum payments is far from enough and often a debt trap. To make substantial progress, you need to pay more than the minimum and adopt a systematic approach. Two primary DIY debt repayment methods are the debt snowball and debt avalanche.

The Debt Snowball Method: Riding the Wave of Motivation

- Explanation: List all your debts from the smallest balance to the largest, regardless of interest rate. Make minimum payments on all debts except the smallest. Attack the smallest debt with all extra funds. Once it's paid off, roll that money (the original minimum payment plus the extra payment) into the next smallest debt.

- Pros: Provides quick psychological wins by eliminating debts quickly, boosting motivation and encouraging persistence. Reduces the number of debts sooner.

- Cons: Mathematically, you may pay more total interest compared to the avalanche method because high-interest debts might be tackled later. It also takes longer to become completely debt-free.

- Best For: Individuals who need early successes to stay motivated and might get discouraged if progress isn't visible.

The "snowball" effect in the debt snowball method isn't just about the growing payment amount; it's about the growing sense of agency and competence in managing finances. Each eliminated debt reinforces positive behavior. Paying off a debt, no matter how small, is a concrete achievement. This achievement can combat feelings of being overwhelmed by debt. Repeated achievements build confidence and belief in one's ability to manage money, a powerful long-term benefit beyond debt reduction itself.

The Debt Avalanche Method: The Financially Savvier Path

- Explanation: List all your debts by interest rate, from highest to lowest. Make minimum payments on all debts except the one with the highest interest rate. Attack the highest-interest debt with all extra funds. Once it's paid off, apply that payment amount to the debt with the next-highest interest rate.

- Pros: Saves the most money on interest in the long run. Often gets you out of debt faster.

- Cons: It might take longer to pay off the first debt, which can be discouraging if you need quick wins for motivation.

- Best For: Highly disciplined individuals who are primarily motivated by saving the most money and can handle a slower start in seeing individual debts eliminated. Especially applicable if there are debts with very high interest rates.

While the avalanche method saves more interest, the feeling of progress can be slower if the highest-interest debt is also a large-balance debt. This can be a hidden demotivator. Conversely, if the highest-interest debt has a small balance, the avalanche method can provide both financial and psychological wins. Thus, the actual structure of an individual's debts (balances vs. rates) influences the experiential pros and cons of each method. Users should analyze their specific debt portfolio.

Table: Debt Snowball vs. Debt Avalanche

| Feature | Debt Snowball Method | Debt Avalanche Method |

| Focus | Smallest balance first | Highest interest rate first |

| Primary Benefit | Psychological wins, motivation | Saves the most interest, faster overall payoff |

| Speed of First Success | Usually faster | Potentially slower |

| Total Interest Paid | Higher | Lower |

| Best For | Individuals needing quick motivation, behavior-driven | Individuals focused on math, disciplined |

Making the Choice: It's Personal

It's important to stress that the "best" method is the one an individual can stick with. The choice between snowball and avalanche is fundamentally a choice between optimizing for psychological well-being versus optimizing for financial efficiency. This highlights the deeply personal and emotional aspect of personal finance, which is more than just a numbers game. A purely "rational" financial decision (like the avalanche method) can fail if the individual cannot adhere to it due to a lack of motivation. Therefore, the "sub-optimal" snowball method might be "more optimal" in practice for some.

Consider "debt snowflakes"—small, extra payments from unexpected savings (e.g., skipping a coffee)—which can be applied to either method to accelerate progress.

Strategy 3: Lighten the Interest Load with Debt Consolidation

Debt consolidation aims to simplify payments and reduce interest by combining multiple debts into a new, single loan or credit card, ideally with a lower interest rate. Benefits include a potentially lower interest rate, a single, more manageable monthly payment, and possibly a shorter repayment timeline. However, a key caveat is that debt consolidation is generally most effective and accessible for those with good credit (often a FICO score of 670/690 or higher).

Option 1: Balance Transfer Credit Cards

- How it Works: Transfer high-interest credit card balances to a new card offering a 0% introductory APR promotional period (typically 12-21 months).

- Key Considerations:

- Promotional Period: Pay off the balance before this period ends to avoid interest on the remaining amount. Successful use of a 0% balance transfer card hinges on paying off the debt within the promotional window, which requires significant discipline. The "teaser" rate can mask a high standard APR that kicks in later, potentially worsening the situation if the balance isn't cleared.

- Balance Transfer Fee: Usually 3% to 5% of the transferred amount. Factor this into potential savings.

- Credit Score Requirement: Typically need good to excellent credit for the best offers.

- Spending Habits: Avoid making new purchases on the balance transfer card, as this can negate the benefits.

- Pros: Significant interest savings during the 0% APR period, simplified payments. For example, a $5,000 debt at 18% APR versus 0% APR can save over $500 in interest in one year.

- Cons: Transfer fees, good credit needed, 0% APR is temporary, potential for high APR after promo period, temptation to spend.

Option 2: Personal Loans (Debt Consolidation Loans)

- How it Works: Take out a new personal loan with a fixed interest rate and term, and use the funds to pay off multiple credit card debts. You then make one fixed monthly payment to the lender.

- Key Considerations:

- Interest Rate: Aim for a rate lower than your current credit card APRs. This depends on your creditworthiness.

- Loan Term: Affects the monthly payment amount and total interest paid.

- Origination Fee: Some loans have this (1%-12% of loan amount), reducing net proceeds.

- Pros: Fixed payments and repayment schedule, potentially lower interest rates, can improve credit mix in the long term.

- Cons: No guarantee of a lower rate, potential origination fees, usually no 0% introductory period like balance transfer cards.

Debt consolidation is not a silver bullet; it's a tool. If the underlying spending habits that led to the debt aren't addressed, consolidation might only be a temporary fix, and individuals could end up with new debt on top of the consolidated loan. The credit score requirement for effective consolidation creates a challenging paradox: those who might benefit most from lower rates (often those with poorer credit due to high debt) may be least eligible for the best consolidation tools. This highlights the importance of early intervention before credit scores are severely damaged. Individuals should explore consolidation options before their debt situation critically harms their credit, or they may be left with fewer, less attractive options.

Table: Balance Transfer Credit Cards vs. Personal Loans (for Debt Consolidation)

| Feature | Balance Transfer Credit Card | Personal Loan (Debt Consolidation) |

| Mechanism | Transfer debt to new card with 0% intro APR | New loan pays off old debts; repay new loan |

| Interest Rate | 0% APR during promo (e.g., 12-21 months) | Fixed rate (varies by creditworthiness) |

| Fees | Balance transfer fee (3-5%) | Possible origination fee (1-12% of loan amount) |

| Credit Requirement | Good to Excellent (Often FICO 670/690+) | Varies; better credit = better rates (Good+) |

| Repayment Structure | Pay off before promo ends; variable APR after | Fixed monthly payments over a fixed term |

| Best For | Disciplined individuals who can pay off debt within promo period, good credit | Those needing a longer fixed repayment term, predictable payments |

Brief Mention of Other Options (with Caveats):

- Home Equity Loans/HELOCs: Can offer lower rates due to being secured by your home, but carry significant risk of losing your home if you default. Generally advised with extreme caution for credit card debt.

- 401(k) Loans: May be an option if credit is poor, but risky due to potential taxes/penalties if you leave your job and can't repay, and impacts retirement savings.

Strategy 4: Be Proactive: Negotiate with Creditors and Explore Hardship Options

Many people don't realize they can negotiate with their credit card companies. If you're unable to make your payments, acting immediately is crucial. Creditors may be willing to work with you, especially if you've been a good customer. They would rather receive some payment than none at all.

What to Discuss and How to Prepare:

- Clearly Explain Your Situation: Be honest about why you're struggling (e.g., job loss, medical emergency, reduced income).

- Know What You Can Afford: Before calling, review your budget (Strategy 1) to determine what you can realistically pay.

- Ask for Specific Assistance:

- Lower Interest Rate (APR): Even a temporary reduction can save money.

- Hardship Program: Many issuers have formal programs that might offer reduced payments, lower APRs, or fee waivers for a period. Specifically asking for a "hardship program" can be more effective than a general plea for help, as it signals awareness of such options and may lead to a more structured and productive conversation.

- Modified Payment Plan: Request a temporary change to your payment amount or due date.

- Fee Waivers: Ask if they can waive recent late fees or over-limit fees.

- Be Prepared to Provide Documentation: Some issuers may ask for proof of hardship.

Creditors are often willing to negotiate not out of altruism, but because it makes financial sense for them. A modified plan that results in partial or full repayment is better for their bottom line than a default leading to a total loss or costly collections. Understanding this dynamic can empower borrowers in negotiations.

Effective Negotiation Tactics:

- Be polite but persistent.

- Document all communication: dates, names, and what was agreed upon.

- If the first representative can't help, politely ask to speak to a supervisor or a retention department.

- Highlight your good customer history if applicable.

Successfully negotiating with one creditor can have a "domino effect," boosting confidence and potentially freeing up cash flow to better manage other debts, even if other creditors are less flexible. Negotiation might lead to a reduced payment or interest on a specific card, freeing up cash in the budget. This freed-up cash can then be applied as extra payments to other, non-negotiated debts, perhaps using the snowball or avalanche method.

When This Strategy Works Best:

- If you're facing a temporary setback and expect your financial situation to improve.

- If your debt isn't overwhelming, but high interest rates are making it hard to gain traction.

Strategy 5: When to Seek Professional Help: Credit Counseling and Debt Management Plans (DMPs)

If debt feels overwhelming, repayments consume a large portion of your income, or DIY methods aren't making a dent, it might be time to seek professional help. If it would take you more than five years to pay off your unsecured debt on your own, you should consider debt relief options.

Non-Profit Credit Counseling Agencies: Your Debt Allies

- Role: Reputable non-profit credit counseling agencies offer guidance on budgeting, money management, and debt repayment. They work with creditors on your behalf.

- Services: Initial consultation (often free), budget creation, financial education, and potentially enrollment in a Debt Management Plan (DMP).

- How to Choose an Agency:

- Non-profit status.

- Accreditation/Affiliations: National Foundation for Credit Counseling (NFCC), Financial Counseling Association of America (FCAA), Council on Accreditation (COA).

- Transparent fee structure. Ask about fees upfront.

- Good reviews and ratings (e.g., BBB A+ rating).

- Avoid for-profit debt settlement companies that make aggressive promises or charge high upfront fees.

Debt Management Plans (DMPs): A Structured Path to Repayment

- How DMPs Work:

- You make one consolidated monthly payment to the credit counseling agency.

- The agency distributes the funds to your creditors.

- Counselors negotiate concessions from creditors, such as reduced interest rates (often to around 8% or even lower) and waived fees.

- Pros:

- Simplified payments (one monthly payment).

- Lower interest rates and reduced total payments.

- Potentially faster debt payoff (typically 3-5 years).

- Creditors may stop collection calls.

- Can gradually improve credit score with consistent payments. DMP clients see an average increase in credit scores (e.g., 62 points for MMI clients after two years, 84 points for MMI clients upon program completion).

- Cons:

- Credit card accounts included in the DMP are usually closed. This can temporarily lower credit scores by affecting credit utilization and account age. The requirement to close credit cards in a DMP is a key behavioral intervention. It forces a break from credit reliance and encourages living within a budget, which is crucial for long-term financial health beyond the DMP.

- Consistent monthly payments are required to maintain concessions.

- Not all creditors may participate or offer concessions.

- Fees are involved. While DMP fees are an added cost, they should be weighed against the potential savings from significantly reduced interest rates. In many cases, the interest saved will far outweigh the DMP fees, making it an economically sound decision despite the cost.

- Typical Fees and Duration:

- Setup Fee: Typically $0-$75 (average around $35-$50).

- Monthly Fee: Typically $25-$50 (average around $25-$30), with a national cap of $79.

- Duration: Most DMPs last 3 to 5 years (36-60 months).

- Impact on Credit Score:

- Potential initial dip due to account closures.

- Positive long-term impact with consistent payments and debt reduction. A DMP itself is not a loan and won't be listed as such, but accounts may show as "paid through DMP".

The success of a DMP largely depends on the individual's commitment to the plan. It's not a passive solution. This implies that a willingness to change and a commitment to financial discipline are prerequisites for benefiting from a DMP. While the agency assists, the ultimate responsibility and effort for success lie with the debtor. It's a partnership.

Table: Debt Management Plan (DMP) Overview

| Feature | Details | Source Material |

| Primary Goal | Structured repayment of unsecured debt with professional help | Debt Snowball Method |

| How it Works | Single monthly payment to agency, which pays creditors, negotiates concessions | consolidatedcredit |

| Average Interest Rate | Often reduced to ~8% or lower (potentially 0-11%) | (Cambridge Credit Counseling 8%) (0-11%) |

| Typical Duration | 3-5 years (36-60 months) | 2025 Credit Card Debt Statistics |

| Average Setup Fee | $0 - $75 (average ~$35-$50) | forbes |

| Average Monthly Fee | $25 - $50 (average ~$25-$30) | fool |

| Credit Card Accounts | Usually must be closed | nerdwallet |

| Credit Score Impact | Potential initial dip; long-term improvement with consistent payments | forbes |

| Best For | Those struggling with multiple high-interest debts, have steady income but need help organizing payments, want to avoid bankruptcy | nerdwallet |

A Note on Increasing Income:

Briefly, in addition to these strategies, increasing income (side hustles, negotiating raises, freelancing) can significantly accelerate debt repayment by providing more funds to allocate. This complements any debt reduction strategy.

Conclusion: Your Path to Debt Freedom

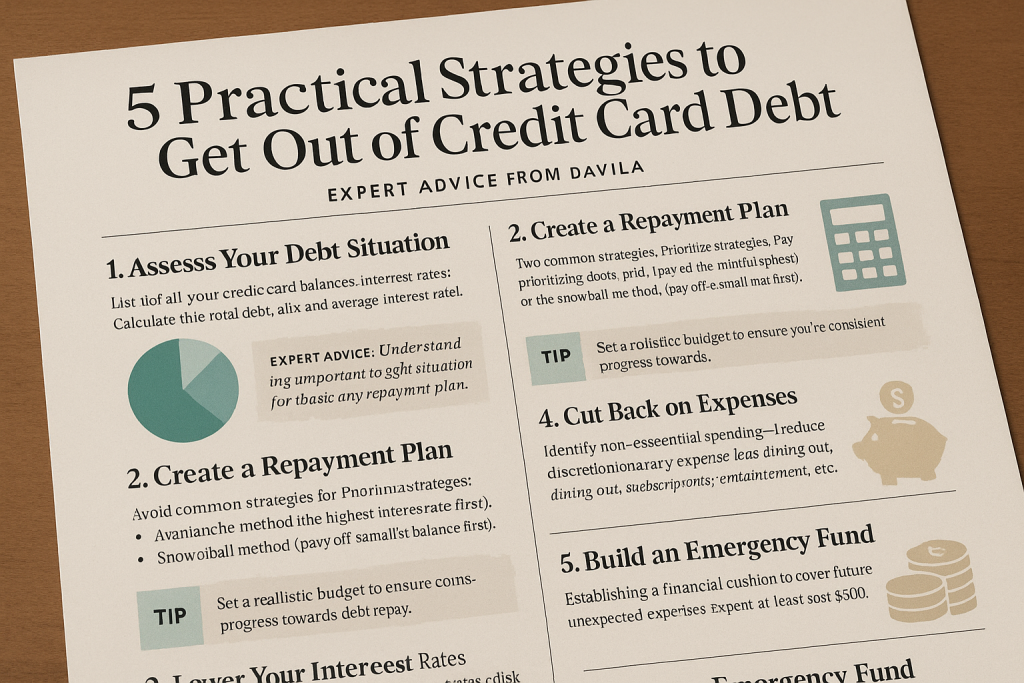

The journey out of credit card debt requires determination and action. Here's a brief recap of the five core strategies discussed:

- Budgeting and Spending Cuts: Establish a clear financial blueprint and consciously control spending to free up cash flow for debt repayment.

- Debt Snowball/Avalanche: Choose a systematic repayment method, either motivating yourself with quick small wins or maximizing savings by prioritizing high-interest debts.

- Debt Consolidation: Combine multiple debts into a single, potentially lower-interest payment via a balance transfer credit card or personal loan to simplify management and reduce interest burden.

- Negotiate with Creditors: Proactively communicate with credit card companies to seek potential interest rate reductions or hardship programs.

- Professional Help (Credit Counseling/DMP): When DIY methods are insufficient, seek assistance from non-profit credit counseling agencies and consider a structured Debt Management Plan.

The key message is empowerment and action. While the journey out of debt requires effort and discipline, it is entirely achievable. The strategies provided form a toolkit; individuals can select and combine the approaches that best suit their unique circumstances.

The journey out of debt is not just a financial process but also an educational one. By actively engaging with these strategies, individuals learn valuable money management skills, gain a better understanding of financial products, and cultivate a more conscious approach to spending and borrowing that will serve them long after the debt is cleared. The common thread in all successful debt elimination strategies is a shift from a passive reaction to one's financial situation to a proactive stance. Whether it's creating a budget, choosing a repayment method, or seeking help, each step involves taking initiative and control, rather than letting debt dictate terms.

Setbacks may occur along the way, but persistence is key. Celebrating small victories can help maintain motivation. The ultimate goal is not just to eliminate debt but to build a healthier financial future. Financial freedom is a worthy pursuit, and taking the first step with these strategies is the most important part of the process.