The Federal Reserve has been a cornerstone of the U.S. financial system for over a century, ensuring stability and efficiency in monetary operations. Among its many responsibilities, the Fed has taken significant strides in modernizing the payment and clearing systems to keep pace with the digital age. One of the most notable recent initiatives is the introduction of FedNow, a real-time payment and settlement service.

What is FedNow?

FedNow is designed to enable instant payment services, operating 24/7/365. This service will allow consumers and businesses to send and receive payments immediately, providing an alternative to the current batch processing systems that often involve delays. FedNow is expected to be a game-changer in the financial sector, offering a more streamlined and efficient means of transaction processing.

How Does FedNow Compare to Existing Systems?

To appreciate the significance of FedNow, it's essential to understand the existing major payment clearing systems in the U.S.:

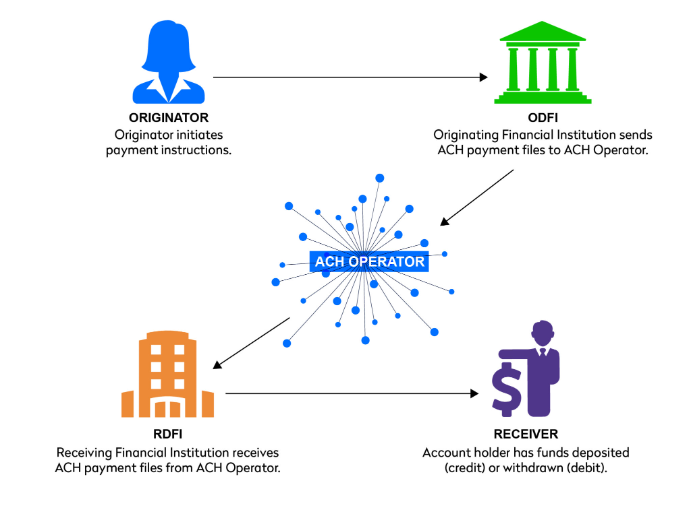

- Automated Clearing House (ACH): The ACH network processes large volumes of credit and debit transactions in batches. While it is highly reliable and widely used for payroll, direct deposit, and bill payments, it typically takes one to two business days for transactions to be completed.

- Fedwire Funds Service: This is a real-time gross settlement system used by Federal Reserve Banks to transfer funds electronically between member institutions. It is primarily used for large-value and time-critical payments, offering same-day settlement.

- Clearing House Interbank Payments System (CHIPS): Operated by The Clearing House, CHIPS is a private-sector alternative to Fedwire for large-value payments. It nets payments at the end of the day, providing efficiency in liquidity management for banks.

Benefits of FedNow

The introduction of FedNow brings several advantages:

- Speed and Efficiency: Transactions are processed in real time, significantly reducing the lag associated with traditional systems.

- Availability: With 24/7/365 availability, FedNow ensures that payments can be made and received at any time, without the constraints of banking hours or holidays.

- Enhanced Security: Instant processing reduces the window for fraud and errors, making transactions more secure.

Implications for Consumers and Businesses

For consumers, FedNow means immediate access to funds, which can be crucial in emergencies or for day-to-day budgeting. For businesses, the ability to receive payments instantly can improve cash flow management and operational efficiency. It also opens up opportunities for innovation in financial services, such as on-demand payroll and real-time bill payments.