Introduction-ACH Transfers and Wire Transfers

In the intricate world of financial transactions, understanding the nuances between different methods of transferring funds is crucial. As a part of CreditWiseHub's commitment to providing professional financial advice and insights, this article delves into the details of ACH transfers versus wire transfers, two prevalent mechanisms in the finance sector. Catering to our financially savvy audience, we aim to unravel these methods' specifics, helping you navigate the complex landscape of banking and financial transactions.

Understanding ACH Transfers

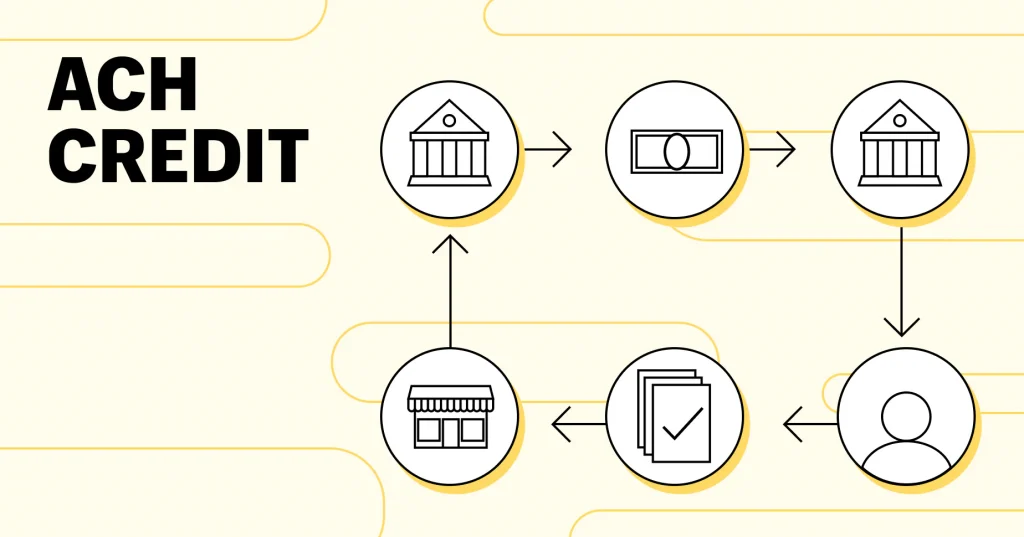

ACH (Automated Clearing House) transfers are a form of electronic fund transfer system used widely across the United States. Managed by the National Automated Clearing House Association (NACHA), this method provides an efficient, low-cost means of moving money between banks without using paper checks, wire transfers, credit card networks, or cash.

Key Characteristics of ACH Transfers

- Cost-Effective: ACH transfers are generally less expensive than wire transfers.

- Batch Processing: Transactions are processed in batches, which means they might take a day or two to complete.

- Versatility: Suitable for various transactions, including direct deposit of salaries, automated bill payments, and business-to-business transactions.

Wire Transfers Explored

Wire transfers, in contrast, are a method of electronic funds transfer from one person or institution to another. A wire transfer can be made from one bank account to another bank account or through a transfer of cash at a cash office.

Key Attributes of Wire Transfers

- Speed: Wire transfers are typically faster than ACH transfers, often completed within hours.

- Global Reach: They can be used for both domestic and international transfers.

- Security: Generally considered a secure method for large transactions.

Comparative Analysis

When it comes to choosing between ACH and wire transfers, various factors come into play. Here's a detailed comparison to guide our clients in the financial business:

| Feature | ACH Transfer | Wire Transfer |

|---|---|---|

| Speed | 1-2 days | Same-day, often within hours |

| Cost | Lower | Higher |

| Volume | High-volume, low-value transactions | Low-volume, high-value transactions |

| Reach | Domestic (U.S.) | International & Domestic |

| Security | High | Very High |

Professional Financial Advice

When deciding between ACH and wire transfers, consider the nature of your transaction. ACH is ideal for regular, low-value transactions, while wire transfers are better suited for urgent, high-value transactions, especially on an international scale.

SEO Optimization

In the realm of finance, being informed is key. At CreditWiseHub, we strive to offer the latest and most relevant information on credit cards, loans, and financial planning. Understanding the difference between ACH and wire transfers is just one aspect of this vast domain.

Conclusion

Whether it's ACH or wire transfers, each serves a specific purpose in the financial ecosystem. As you navigate your financial journey, whether it's related to credit cards, loans, or broader financial planning, understanding these tools can significantly impact your decisions. Remember, the choice depends on your specific needs – speed, cost, volume, and reach.

Stay informed and ahead in the financial game with CreditWiseHub, your partner in financial expertise and advice.

"If you found the insights shared in this article valuable and are keen on exploring more expert recommendations, I invite you to delve into our curated selection of financial resources. The additional recommendations are part of our affiliate program, ensuring you get the best deals while supporting our endeavor to provide quality financial advice."