Introduction

In the ever-evolving world of finance, understanding the diverse spectrum of loan options available can be a game-changer for both seasoned investors and new entrants. At CreditwiseHub, we delve into this colorful array, offering insights and professional advice to guide you through the myriad of financial solutions.

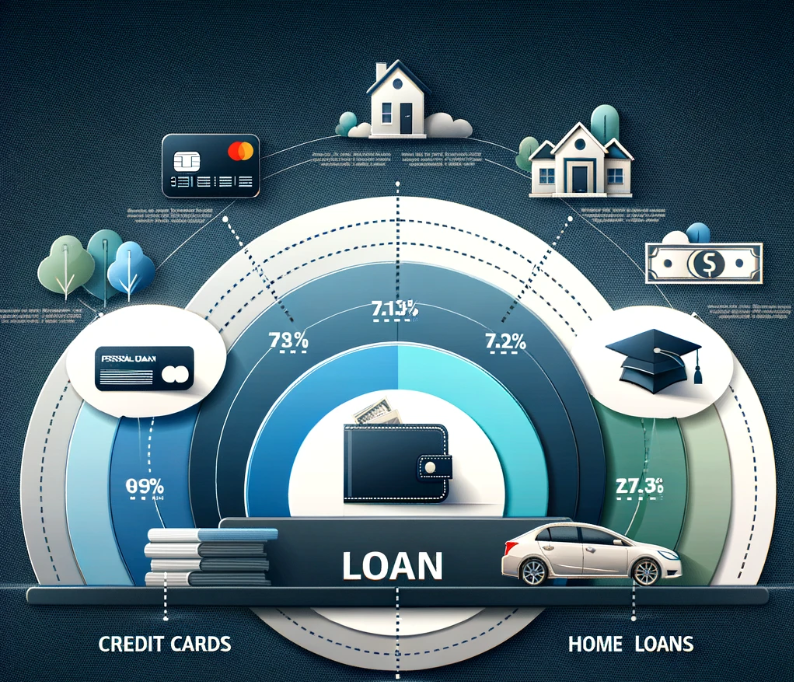

The Loan Landscape: Navigating Through Colors

Personal Loans: A Versatile Choice

Personal loans stand out in the financial spectrum for their versatility. Whether it's for consolidating debt, funding a large purchase, or covering unexpected expenses, these loans provide a straightforward solution. The key is to understand the terms, interest rates, and repayment schedules to ensure they align with your financial goals.

Credit Cards: More Than Just a Plastic

Credit cards, a vital part of modern finance, offer more than just convenience. They can be a strategic tool for managing finances, earning rewards, and building credit. However, the key to using credit cards wisely lies in understanding the terms, interest rates, and potential fees.

Home Loans: Foundation of Your Financial Portfolio

For many, a home loan is the largest financial commitment they will make. Navigating this part of the loan spectrum requires understanding the types of home loans available, the implications of fixed versus variable interest rates, and the impact of loan terms on monthly payments and total interest paid.

Auto Loans: Steering Your Financial Decisions

Auto loans cater specifically to vehicle financing. The choice between dealer financing and bank loans, understanding depreciation, and the impact of loan terms and interest rates on the overall cost are critical areas to consider.

Student Loans: Investing in the Future

Student loans are an investment in one’s educational and professional future. Understanding the difference between federal and private student loans, the implications of interest rates, and repayment options is crucial for making informed decisions.

Business Loans: Fueling Growth

Business loans are vital for funding operations, expansion, and capital investments. Understanding the types of business loans available, their requirements, and the implications for your business’s financial health is essential.

Professional Financial Advice: Making the Right Choice

Navigating the loan spectrum requires balancing your current financial situation with your long-term goals. Here are some professional tips:

- Assess Your Needs: Clearly define the purpose of the loan and how it fits into your broader financial plan.

- Compare Options: Look beyond interest rates; consider loan terms, fees, and flexibility.

- Credit Health: Understand your credit score and how it affects your loan options.

- Read the Fine Print: Be aware of all terms and conditions, including penalties and hidden fees.

- Plan for Repayment: Ensure that your budget can comfortably accommodate loan repayments.

Conclusion

The loan spectrum offers a diverse range of financial solutions, each with its unique characteristics and implications. By understanding these options and seeking professional advice, you can make informed decisions that align with your financial goals. CreditwiseHub is here to guide you through this journey, offering insights and advice on loans, credit cards, and finance. Stay informed, make wise decisions, and navigate the financial world with confidence.