Introduction

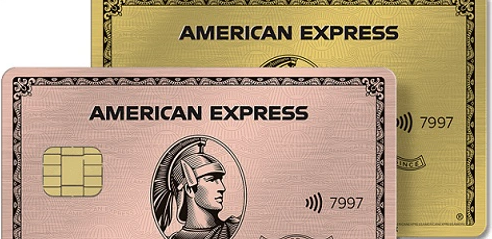

In this comprehensive review, we delve into the American Express Gold Card, often known as the Gold or Rose Gold Card due to its two distinct card face colors. This card stands apart from its premium counterpart, the Platinum Card, as it caters to individuals who enjoy dining out, grocery shopping, and even booking flights. It's a versatile card suitable for students and those comfortable with an annual fee. Personally, my affinity for dining out and frequent supermarket visits led me to apply for the Gold Card. Additionally, the aesthetic appeal of the Rose Gold variant sealed the deal, as the points accrued with both the Platinum and Gold Cards can be combined. I wholeheartedly give it a five-star rating, partly due to its enticing Rose Gold design.

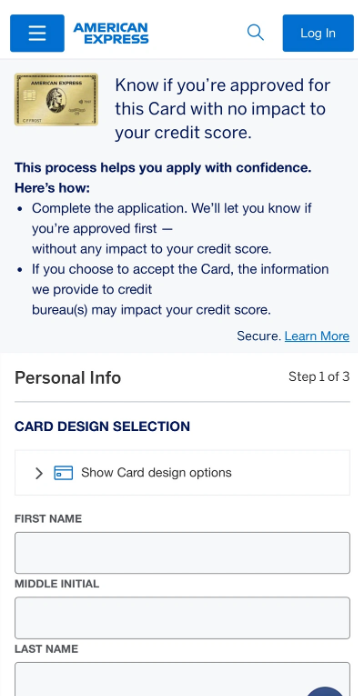

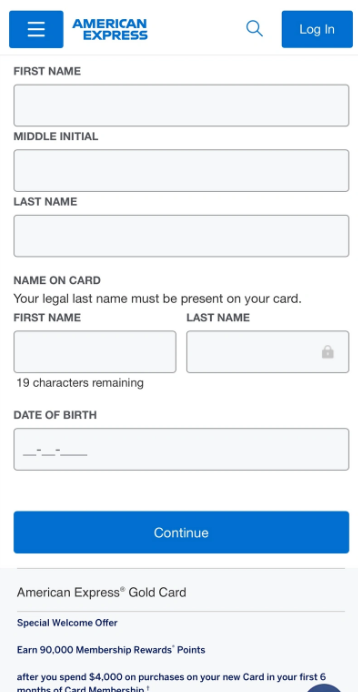

Application Process

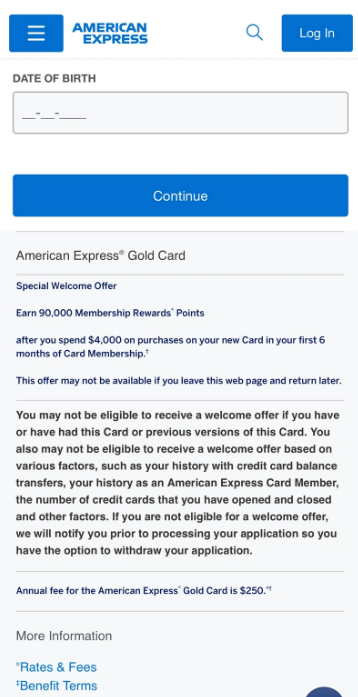

The application process requires a Social Security Number (SSN), and the online application yields results promptly. Upon approval, you can activate the electronic card and add it to your Apple Wallet for convenient and secure use. With two card face color options, gold or rose gold, choose the one that suits your preference. I, like many others, lean toward the allure of rose gold for its visual appeal. American Express excels in efficiency, delivering the physical card within a week. Once in possession, it becomes your go-to companion for dining, shopping, and more.

The annual fee for the Gold Card is $250, a reasonable cost, especially for students and young professionals. The first five additional cards are free, with a $35 fee for each subsequent one. It's essential to consider your individual circumstances before applying for any credit card. Keep in mind that each card application results in a hard pull on your credit report, affecting your credit score. This holds true whether you open multiple cards simultaneously, as they count as a single hard pull.

Card Benefits

While the Gold Card offers fewer benefits compared to the Platinum Card, it more than covers its annual fee:

- $120 Dining Credit: Enroll in this benefit to receive $10 in credit every month, redeemable at select establishments, including Grubhub, Cheesecake Factory, Goldbelly, Wine.com, Milk Bar, and designated Shake Shack locations.

- $120 Uber Cash: Enjoy $10 in Uber Cash each month, usable for both Uber rides and Uber Eats. When combined with the Dining Credit, ordering Shake Shack takeout can yield a generous $20 credit.

- $100 Hotel Collection: To qualify, book through Amex Travel and stay for a minimum of two nights. The credit is not applicable for single-night stays.

These primary benefits can offset the card's annual fee. Additionally, the Gold Card offers standard perks such as no foreign transaction fees, access to preferred seating at select events, and insurance coverage for luggage and car rentals (note that coverage exclusions may apply depending on the rental location, including Australia, New Zealand, and Italy).

Compared to the Platinum Card, the Gold Card carries a lower annual fee and fewer benefits. However, its high value proposition remains evident, especially considering the robust rewards for dining, supermarket shopping, and airfare. The card's visual appeal in both gold and rose gold variants adds to its attraction.

Earning Points and Rewards

The American Express Gold Card boasts a significant advantage in terms of earning points. You'll earn four times the points for dining and supermarket purchases, with a cap of $25,000, totaling 100,000 points for supermarket spending. Purchasing flights directly through the Amex website earns you three times the points, slightly trailing the Platinum Card's five times rate but still impressive. All other purchases accrue one point per dollar spent.

New cardholders often receive introductory point bonuses upon meeting specific spending requirements within the first six months. These points can be retained and redeemed for statement credits or, for better value, for booking flights, a popular choice among cardholders. You can also refer friends and earn additional points, with an annual cap on referral bonuses.

Points earned can be redeemed for various purposes, including shopping for travel essentials like Tumi luggage or Bose headphones and speakers. Leveraging the accumulated points for discounted purchases adds to the card's value. Furthermore, the Amex App provides access to various offers that can be added to your card, allowing you to accumulate points with select merchants. Note that each offer can only be applied to one card, so choose wisely before adding them.

Customer Service

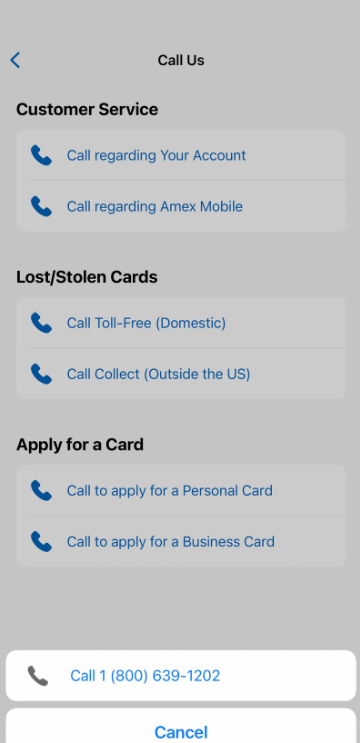

American Express's customer service is top-notch, with representatives available 24/7. Whether you're in the United States or abroad, you can easily reach them via chat or phone. They are responsive and ready to assist with any inquiries or issues you may encounter.

Personal Experience

My experience with the American Express Gold Card has been highly satisfactory. Its rewards for dining and grocery shopping are unmatched, making it a valuable asset for food enthusiasts. After accumulating points, I can redeem them for flights, allowing me to explore culinary delights worldwide.

In conclusion, when considering card options, it's essential not to choose blindly. Opt for the one that best aligns with your lifestyle and financial situation rather than the most expensive or prestigious one.

In summary, the American Express Gold Card is a versatile and rewarding credit card, ideal for individuals who frequently dine out, shop at supermarkets, and travel. Its combination of dining and travel benefits, along with a visually appealing design, make it a valuable addition to your wallet.